What is a storage hub?

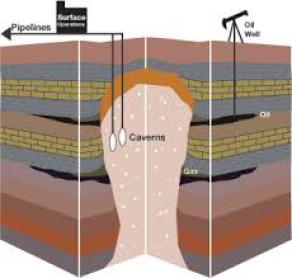

A storage hub is a single or set of, storage locations for raw material hydrocarbons such as ethane and butane. It can also include manufactured chemical intermediates such as ethylene. These storage locations are typically below ground in salt domes, natural gas caverns, or other non-porous formations.

A storage hub includes a backbone of pipelines from source locations to key manufacturing locations plus associated monitoring equipment and appropriate pumps or compressors to move the materials. Some hydrocarbons, especially methane (or natural gas) and crude oil can also be connected to a large country or continent wide pipeline system.

Most storage hubs act purely as a materials storage and transportation network. However, some also act as or include financial exchange structures with price-setting based on local or regional supply and demand. The materials all meet standard specifications.

How does it work?

Producers of hydrocarbons or chemicals link to the pipeline system and flow their material to the storage locations. Consumers of these materials similarly link to the pipeline system and withdraw materials. This flow of materials is governed by contracts.

Third parties independently monitor and report on flows and storage levels. They also assay the materials to ensure that standard specifications are met. Finally, they are tasked with the smooth operation of the storage hub, which includes both routine maintenance and long-term capital maintenance and needs.

Fees are collected for storage, input and withdrawal of materials. These fees include two components: the on-going payments to third parties to keep the operations running and a payback portion for the large capital outlays needed to establish the storage hub.

A governing body of stakeholders overseas the performance and negotiates the fees for third parties. They make decisions regarding changes in the operation of the storage hub. Changes to capital payback portion can also be made by this governing body.

Is the storage hub a new concept?

No, it has been around for decades and successfully implemented globally in many locations. It is considered standard practice in the petrochemical industry.

The largest example is the Mont Belvieu storage hub on the U.S. Gulf Coast. Other prominent global examples can be found in Rotterdam, Netherlands and Al Jubali Saudi Arabia. There are many others globaly, most of which have been in opearation for decades.

What are the benefits of a storage hub?

The benefits are multiple and have a considerable and long term impact on the region, as demonstrated by existing global storage hubs in fostering petrochemical investment and growth.

The storage hub is essentially a pooled resource of raw materials, overall capital outlays are dramatically reduced for any single producer or consumer. Both cost and risk is spread among a number of stakeholders.

If a financial exchange structure or system is included, then more transparent and market efficient pricing provides an added benefit producing a level playing field available to all.

However, the largest economic impact is simply the increase in attractiveness of the region to additional — and very large — investments along with potentially hundreds or thousands of high-paying, STEM (Science, Technology, Engineering and Mathematics) jobs. These include investments and jobs in upstream, midstream and downstream facilities.

Petrochemical Industry Investments

If the storage hub includes petrochemical building blocks such as ethylene from regional cracker facilities, then it opens up the region to the many consumers of ethylene (more than 20 distinct chemical processes) that are too small by themselves to invest in an ethane cracker. By consuming ethylene, they, in turn, create additional demand for ethylene which could lead to ethane cracker expansions or additional crackers. This in turn, causes increased demand for ethane from natural gas producers and midstream companies.

These additional capital investments not only bring large numbers of jobs but also increased taxes for the region to grow. It should be noted that each petrochemical manufacturing job historically creates additional 2 to 5 in direct jobs in the community.

Strategic security?

Security, and thus reduced risk, is an important component as well. The storage hub features underground storage and transportation, widely accepted as much safer and more secure than above ground storage and transport. In addition, producers of these materials have access to a larger connected customer base while consumers of these materials have access to multiple suppliers, minimizing the impact of any single interruption in the demand or supply chain.

Creation of another large storage hub in the U.S. geographically distant from the Mont Belvieu hub provides strategic security on a national level. The geographically distant hub would lead to the formation of a petrochemical complex in that location. Thus providing both storage and production separation and thus increased security from any single event. An event could be an act of god such as the hurricane Katrina, which caused shutdown of most of the Gulf Coast petrochemical complexes and resulting nationwide shortages. Events could also be man-made such as terrorism. A geographically separate storage hub and petrochemical base in the Appalachian basin provides strategic security.

Strategic security was the motivator for the US Government investment in the Mont Belvieu hub in the 1950s, and expansion to include the strategic petroleum reserve in the 1970s. It was also the driver for the Philadelphia Storage Hub started in the late 1960s as a cold war era icon as the hub was carved from granite formations and is reputed to be able to withstand an H bomb within 50ft without damage.

Where would be built?

That is still to be determined and depends heavily on local geology. Underground storage sits typically impermeable underground salt domes will need to be evaluated. Many such sites exists, their suitability and capacity are unknown.

One proposal is essentially to follow the existing Appalachian basin chemical footprint and run along the Ohio River between West Virginia and Ohio, with small side branches. Which covers nearly the same distance as the Mont Belvieu Hub. Leading to the name ‘Mont Belvieu along the Ohio river’. Extensions along the Ohio River to Kentucky and Indiana petrochemical complexes have also been contemplated.

Raw materials and energy for chemical production are economically advantaged with production in the Basin, versus other global and even US Gulf Coast locations. This potentially leads to $36 billion in new chemicals and plastics industry investments. From this perspective, the sizeable investments needed for an Appalachian Storage Hub are justified and the game changing nature of a hub confirmed.

Chemical Intermediates, what is the relationship to the storage hub?

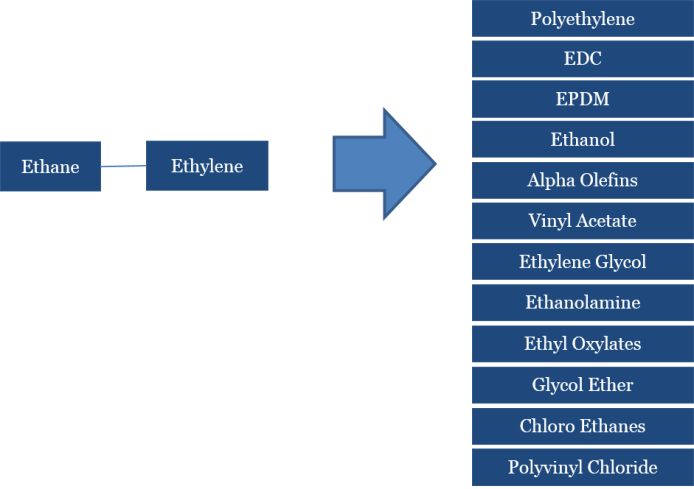

The regional focus has been on attracting large global scale ethane crackers, which is understandable considering the $5 billion investment in one plant. These ethane crackers, convert ethane into ethylene and in a separate step polymerize ethylene into polyethylene, the final product which is shipped to plastics processors.

Ethylene, the chemical intermediate in these plants is also a useful intermediate to produce a number of other chemical products, some of which are outlined in the graphic.

The chemical company with the ethane cracker has expertise in the technologies for that process and in marketing the end use polyethylene. They rarely produce any of these other ethylene based products. Instead they are produced by other chemical companies. As we have seen in the US Gulf Coast and other others with a high concentration of petrochemical investment a win-win cycle is created.

The cracker plant owner can at modest cost increase the output of ethylene and thus increase scale and spread overhead and non raw material costs over a larger output, increasing profitability. The ethylene consuming chemical company gains access to ethylene without an investment and knowledge of the technologies. They also gain ethylene at close to producer costs from a plant that is far larger in scale than their demands required.

This results in two new investments, the increase in cracker capacity to produce ethylene and the new ethylene consuming plant. The investment of these ethylene consuming plants can vary from quarter of a billion dollars to several billion for world scale units. Since the region has the lowest ethane costs globally, and local demand for these downstream ethylene based products, they are economically advantaged and local production will be the most profitable option.

What could be stored in the storage hub?

Other hubs have a wide range of raw materials from crude oil to chemical intermediates. For the unique case of an Appalachian Storage Hub, the key raw materials for the chemical industry – ethane and propane are high on the list. Chemical intermediates ethylene and propylene and chlorine – the high volume building blocks are also candidates. Beyond that market demands will dictate.